Dreaming of a European vacation but wondering how you’ll ever afford it? Saving for a trip to Europe from the US can seem daunting, but it is achievable. With these 13 money-saving tips, you’ll soon master how to save for a trip to Europe.

In this post, you’ll learn:

- How to budget for your Europe trip expenses

- Ways to earn and save more money for your trip

- Ideas on how to reduce your overall trip costs

As you begin planning your Europe trip, you might want to check out more of our travel planning resources. You should read our guides on how to stay healthy while traveling, travel documents you need before going abroad, and the best women’s shoes for Europe in summer.

Disclosure: This guide on how to save money to travel to Europe contains affiliate links. I may earn a commission when you click on one of these partner links and make a purchase.

13 Tips for Saving Money to Travel in Europe

If traveling to Europe has been a dream vacation you’ve wanted to take for as long as you can remember, why not begin taking the necessary steps to make it a reality?

Whether you want to see the beauty of Greece or follow a two-week Spain and Portugal itinerary, you can make your dream vacation in Europe a reality with budgeting and planning.

So, if you’re feeling discouraged about the financial aspects of preparing to vacation in Europe, you should know that saving for such a trip is entirely doable.

In this post, you’ll learn how to budget for your trip, ways to save and earn money for your vacation, and the most affordable times to book travel to Europe.

1. Create a Trip Budget

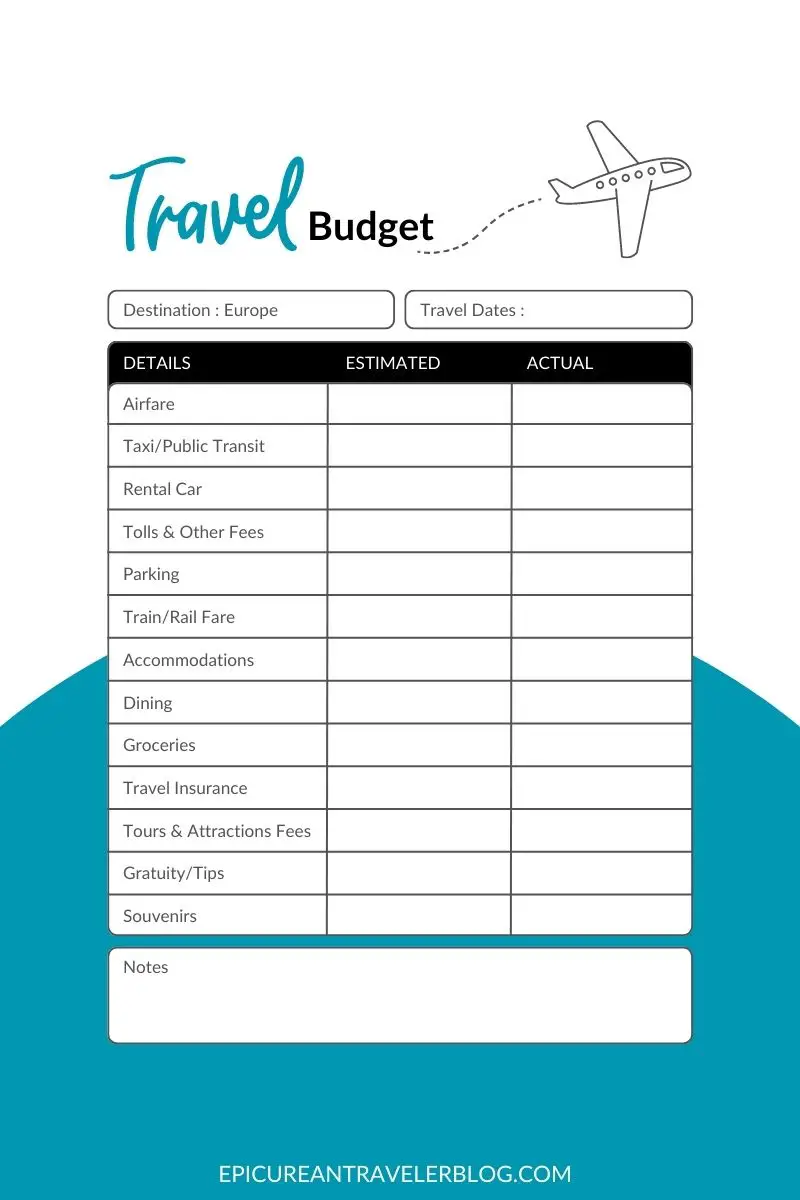

The first step toward saving money for your European vacation is to set up your trip budget, which will require research.

By creating a trip budget, you’ll know how much money to save for your trip. Then, as you plan your trip, you’ll use your budget to track your spending on transportation, lodging, activities, and other travel expenses.

How much money do you need to save for your trip? The answer will depend on your budget constraints, desired destination(s), trip length, travel style, and travel dates.

You should research the costs of flights, accommodations, food, transportation (rental car, taxis, rail and ferry tickets, etc.), travel insurance, tour and attraction tickets, and other miscellaneous expenses. Don’t forget to budget for any European travel essentials you need for your trip, too!

Whether you create your budget spreadsheet using Google Sheets, Microsoft Excel, or old-fashioned pen to paper, you should include line items for each aspect of your trip. You can use the Europe trip budget planner below to get started.

2. Add Travel to Your Personal Finance Budget

Once you have created your Europe trip budget, you should add your European vacation as a line item on your personal finance budget.

If you don’t already have one, you’ll first need to create a monthly budget for your personal finances. Make sure your personal budget includes both your fixed and variable expenses.

This will give you a better understanding of what you can and cannot afford. Your budget should include everyday expenses, splurges like dining out or new clothes, and unexpected expenses, such as a surgical procedure at The Bunion Cure at Northwest Surgery Center.

3. Cut Unnecessary Expenses

The easiest way to save money for a trip to Europe is by reallocating the money you typically spend on variable expenses in the everyday expenses and splurges categories of your budget to your travel fund.

Here are some common ways to reduce your expenditures:

- Brew your morning coffee at home rather than purchasing it from a coffee shop.

- Cook meals at home and pack your own lunches and snacks for work/school rather than eating out.

- Use public transportation, ride a bicycle, or walk rather than taking taxis or ride-shares.

- Reduce your spending on gas by carpooling to work, school, and/or social events, splitting the cost with friends/co-workers.

- Cut your cable bill and opt for 1-2 streaming services instead.

- Cancel unused or unnecessary subscriptions.

- Shop your own closet. It’s ok to rewear the same outfit to special events!

- Need something? See if you can borrow the item or look for secondhand options at consignment and thrift stores, estate and garage/yard sales, and online marketplaces.

Every little bit saved on these everyday expenses and splurges can be reallocated to your European vacation fund. It may grow slowly, but you will see your travel fund increase after reallocating these savings.

4. Avoid Foreign Transaction Fees

Did you know you can incur a foreign transaction fee before stepping foot outside the US? That is because a foreign transaction fee is not based on where you are located at the time of purchase.

Rather, a foreign transaction fee is charged by your credit card issuer when financial transactions are made outside of the country. For example, you could incur this fee when purchasing your rail tickets online in advance of your Europe trip.

Though the fees are relatively small at 1-5%, they add up as you are booking your European vacation and, of course, while purchasing meals and souvenirs during your trip.

So, before you make reservations or bookings for your Europe trip, check that your credit card doesn’t charge foreign transaction fees.

5. Open a Travel Rewards Card

Another way to save money for Europe is to open a travel rewards credit card. Travel rewards cards allow you to save money by redeeming the points you’ve earned on both everyday and travel expenses for airfare or hotels.

Some travel rewards cards also offer additional perks, such as protection on travel purchases, car rental insurance, lost luggage insurance, or airport lounge access.

Additionally, sign-up bonuses can offset some of your Europe trip expenses. For example, you could earn 75,000 bonus miles, a $750 value, when you open a Captial One Venture Rewards Credit Card and spend $4,000 within the first three months.

No foreign transaction fee is another perk of most travel rewards credit cards, making them money-saving payment methods while abroad.

Of course, with great benefits comes a cost. You should carefully consider if opening a travel rewards credit card is good for your financial wellness.

On thing to consider is the card’s annual fee, with some travel rewards cards charging $95 or more. Another thing to consider is your credit score. Typically, you need a good to excellent credit score to be approved. Finally, you should be about to pay off monthly balances.

In addition to general travel rewards cards, you may also consider credit cards that offer benefits and the ability to earn miles/points for your airline or hotel brand of choice. The benefits of these cards are particularly advantageous for brand-loyal travelers and frequent fliers.

6. Earn More from Your Savings

As I previously mentioned, every little bit counts. That is why you might consider putting your vacation funds into a high-interest-yielding savings account. You’ll literally be earning vacation funds while you sleep!

Some online savings accounts offer over 4% APY as of July 2023. Additionally, some high-yield online accounts have no monthly fees, foreign transaction fees, and/or ATM fees.

With one of these accounts, you’ll earn more from your savings while potentially reducing banking fees that add up over time.

7. Utilize Rebates, Coupons, and Discounts

Another way to save money for your Europe trip is to shop using rebates, coupons, and discounts. You can earn cash back when you shop for groceries, Europe travel essentials, trip bookings, and more.

There are several mobile apps and web browser extensions you can install to earn rebates. I use Ibotta, Capital One Shopping Rewards, and Rakuten browser extensions to earn cash back from my online purchases. I also earn cash back from Ibotta on in-person grocery shopping by clipping rebate coupons on the mobile app.

You can use Ibotta to save money as you book your Europe trip, too. Ibotta changes its offers occasionally, but a quick browse as I penned this post showed cash-back earnings of 10% for AirportParking.com, 4% for Viator, 3.5% for Priceline, and 3% for Booking.com purchases, among others.

By using multiple rebate apps or browser extensions, you can maximize your savings. For example, Ibotta may offer 3% cash back on Priceline purchases, while Rakuten may beat that deal, offering 6% back.

Rakuten also has rebate offers on travel booking sites, airlines, hotel chains, car rental services, cruise lines, and more travel-related products and services.

What I like most about using the Capital One Shopping Rewards browser extension is that it will automatically run coupon codes to get you the best deal when you check out from any online retailer. I’ve saved $788 using Capital One Shopping Rewards while online shopping between 2021 and 2023.

8. Pick Up a Side Hustle

If you need additional savings for your Europe trip, consider a side gig to bring in extra income.

For example, you could take online market research surveys, offer freelance professional services, drive or pick up delivery orders for a ride-sharing service, care for children or pets, or create your own small business.

A side hustle that aligns with your skills could be a lucrative way to earn more money for your Europe trip.

9. Sell Your Stuff

Do you have items you no longer want but could be helpful to someone else? Selling those no-longer-needed belongings is another way to earn more money for your European vacation.

Furniture, collector’s items (especially in the original packaging), and gently used designer or brand-name clothing could be more valuable than you think. Before listing them for sale, you should carefully research their value.

Once you have established the value of your item, you can take it to a consignment or resale shop in your area or list it on an online marketplace. Poshmark is best for designer and name-brand clothing, especially in “like new” condition with attached tags.

You can also sell gently used clothing, household items, furniture, and cars on free online marketplaces like Facebook Marketplace, Craigslist, and OfferUp.

If you have many items to sell that aren’t specialty or higher-priced items, consider hosting a yard or garage sale. You can also partner with a neighbor, friend, or relative to advertise a multi-household sale, which may attract more customers.

10. Ask for “Travel” as Your Gift

Do your relatives ever ask what you want for your birthday, Christmas, or other gift-giving occasions? Ask for a contribution toward your upcoming trip.

For example, if this dream European vacation is your honeymoon, you can set up a virtual honeymoon fund in lieu of or in addition to a traditional wedding gift registry.

If asking for cash feels too awkward, you could request gifts that offset your travel expenses. Gift ideas include airline gift cards or travel essentials you still need, like packing cubes or a plug adapter.

RELATED POSTS:

- Cool Travel Gifts for Him

- Travel Gifts for Harry Potter Fans

- Gifts for Wine Travelers

- Gifts for Coffee Travelers

11. Invite Friends to Split Costs

One of the best ways to save money when traveling is to share the cost with travel companions. Rather than saving up for a solo trip, ask a friend or a group of friends to join you.

Some travel expenses, such as your flight to Europe, are your own financial responsibility, but you can share the cost of lodging and ground transportation.

However, before you invite your significant other, friends, or family members to join you, you should ensure your travel styles and budgets align. We share more tips on planning a trip with friends in this post.

12. Avoid Traveling in Peak Tourism Season

Traveling outside the high-tourism season is the surest way to reduce the overall cost of your trip. Airfare and lodging prices peak in the summer and are typically high again around Christmas and New Year’s in many European destinations.

Therefore, visiting Europe during the shoulder seasons is typically more cost-effective. Airfare and hotel prices are typically lower during the weeks before and after summer. Additionally, spring and fall are optimal times to visit because of the smaller crowds at popular attractions. Meanwhile, the weather is still relatively pleasant in much of Europe.

Now, if your dream European vacation involves sipping glühwein at Germany’s Christmas markets or swimming in the warm Mediterranean Sea, this bit of advice may not apply. However, if you are open to traveling during the spring or fall, you will likely save money on your two heftiest travel expenses—airfare and accommodations.

13. Choose a Cheaper Flight

Your flight will be one of the most significant expenses when planning your trip to Europe.

However, the more flexible you can be with your travel itinerary, the cheaper your flight may be. You’ll usually save money on airfare if you can schedule your flights for midweek rather than Friday through Monday.

You can also use mobile apps and online tools, like Skyscanner and Google Flights, to search for and alert you to cheaper fares.

Money-Saving Tips for Travel in Europe

If you are planning your dream trip, I hope you learned some money-saving tips for traveling to Europe.

In this post, I recommended researching prices to create your trip budget. This will help you determine how much you’ll need to save for travel expenses.

I’ve also shared strategies for saving or earning more money for your European vacation fund. You could increase your travel funds by putting your savings into a high-interest-yielding account, taking on a side hustle, asking for trip-related gifts, or selling gently used items you no longer need.

Finally, I also shared ideas for lowering costs when traveling to Europe from the US. Inviting travel companions to join you or taking your trip at lower-cost times will decrease overall trip costs.

Need inspiration for your Europe trip? Browse top Europe tours and activities below!

TL;DR: Remember these tips to save money for a Europe trip!

- Research travel costs for Europe to create your trip budget, and use your budget spreadsheet to track your spending.

- Cut back on your everyday expenses and splurges to save money for your European vacation.

- Switch to a high-interest-yielding bank account, ask for cash gifts, sell your gently used stuff, and/or get a side hustle to earn more money for your European vacation fund.

- Download rebate mobile apps or add their browser extensions to earn cash back as you shop and make trip bookings.

- Open and use a travel rewards credit card for your everyday expenses to earn travel rewards that can be redeemed for airfare, hotel stays, car rentals, and cruises.

- Use Skyscanner or Google Flights to search for cheaper airfare.

- Flying midweek, travel in Europe’s shoulder season, or share accommodations with travel companions.

- Pay for your hotels, rail tickets, and tickets for attractions and tours with a credit card that has no foreign transaction fee.

- Bonus Tip: When you are in Europe, pay with a credit card to get the best exchange rate.

Read These Posts for More Europe Travel Tips

- Packing for Europe: How to Pick the Best Women’s Shoes to Wear in Europe [Summer Edition]

- 12 Famous French Foods in Paris to Eat — And One to Avoid!

- Five Amsterdam Restaurants Where You Should Eat (According to a Netherlands Travel Expert)

- Top 8 Copenhagen Seafood Restaurants

- Cyprus Dining Guide: Best Restaurants in Five Top Cyprus Travel Destinations

- Paros, Greece Travel Guide: Tips for Visiting the Greek Island

- 10 Photos of Ireland to Inspire Your Trip

- Italian Coffee Guide: 15 Things You Should Know Before Drinking Coffee in Italy

Planning a trip to Europe? Save this post to your Europe travel board on Pinterest to easily refer back to it later!

Editor’s Note: Photo credit for the lead image of a traveler counting cash while trip planning (© Syda Productions/Adobe Stock)

Leave a Reply